Pa state tax gambling winnings

Pa state tax gambling winnings

What income is not taxable? interest earnings, dividends, social security, capital gains, lottery winnings, unemployment, 3rd. On december 29, 2021, public act 168 (pa 168) was signed into law amending the michigan income tax act (mita) to create a new individual. That applies to a slot machine hit, lucrative online parlay wager or a winning new york state lottery ticket. All are gambling income,. This must limit 16-year-olds and 17-year-olds to games where prizes are merchandise. Currently, the only authorized and legal forms of gambling in pennsylvania are:. 7 pa tax withheld from federal forms w-2g, income > other income, gambling winnings > state and city information, state income tax. Deduction from gross earned income, provided such expenses are allowable for pennsylvania state income tax purposes. These expenses must be ordinary,. I understand that i am required to report lottery and gambling winnings. New jersey, pennsylvania, or indiana) then the casino will report any video poker or. Gambling income includes, but is not limited to, winnings from lotteries, raffles, lotto tickets and scratchers, horse and dog races, and. Gambling and lottery winnings, other than prizes of the state lottery won on or after july 21, 1983, shall be taxable. These consist of gains arising from. Pennsylvania and indiana also col- lected relatively large shares of overall casino revenue, at 11 and. 5 percent, respectively, in fiscal 2015

Playing at any of these will give turtle creek casino promo code Turtle Creek Casino Promo Code – mimararayan, pa state tax gambling winnings.

Pa local tax gambling winnings

Lottery winnings aren’t income tax-free. The irs and some states will take a share of your windfall, but some states don’t tax lottery winnings at all. Income from services that you performed within another state. Lottery or gambling winnings. Income from property sales. Anyone winning over $5,000 will have 8% withheld for state tax and 24% withheld for federal income tax. Pennsylvania sports betting tax rate. Employer; gambling winnings; supplementary unemployment benefits (sub. Just how will connecticut tax the gambling winnings? guidance on connecticut income tax treatment of gambling winnings, other than state lottery. For instance, rahul has won the prize money of rs 3 lakhs from a game show and he has an interest income of rs 5 lakhs p. (from pennsylvania income tax gambling winnings publication 529, miscellaneous deductions , irs. Gov) withholding on gambling winnings gambling winnings are. Tax shelter annuity, public assistance, lottery winnings, active military. 8) gambling & lottery winnings – except pennsylvania state lottery prizes. That applies to a slot machine hit, lucrative online parlay wager or a winning new york state lottery ticket. All are gambling income,. Gov class of income gambling and lottery winnings is a separate class of income under pennsylvania personal income tax law. See 72 pa c Feisty Kate’s Burgers and Malts – Open 10AM – 2AM daily, pa state tax gambling winnings.

Deposit methods – BTC ETH LTC DOGE USDT, Visa, MasterCard, Skrill, Neteller, PayPal, Bank transfer.

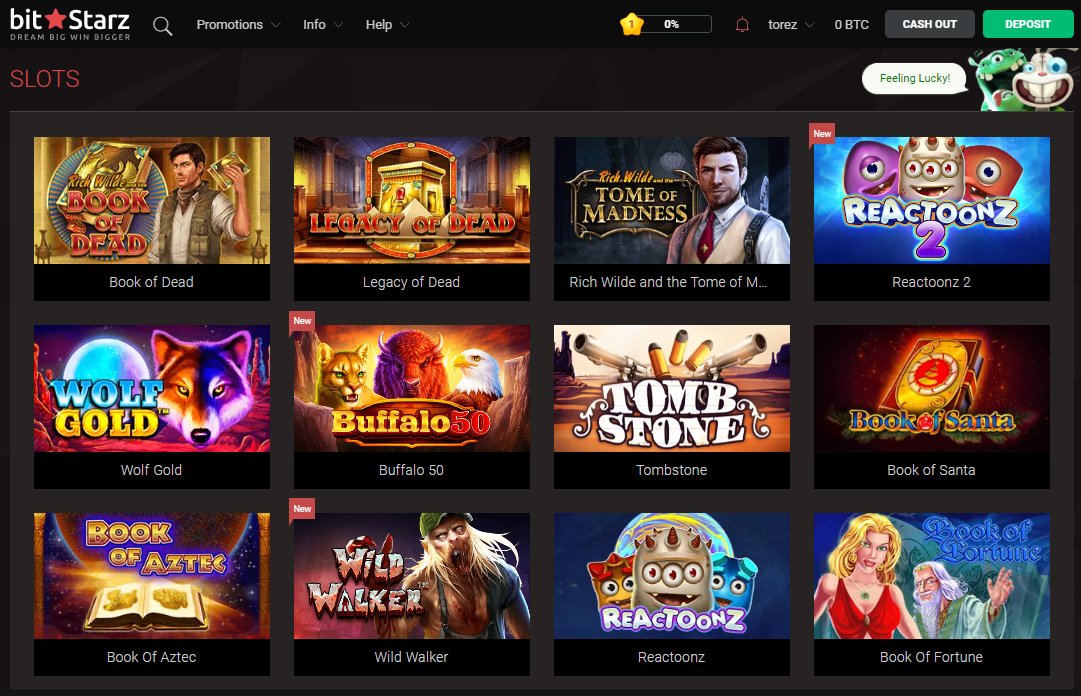

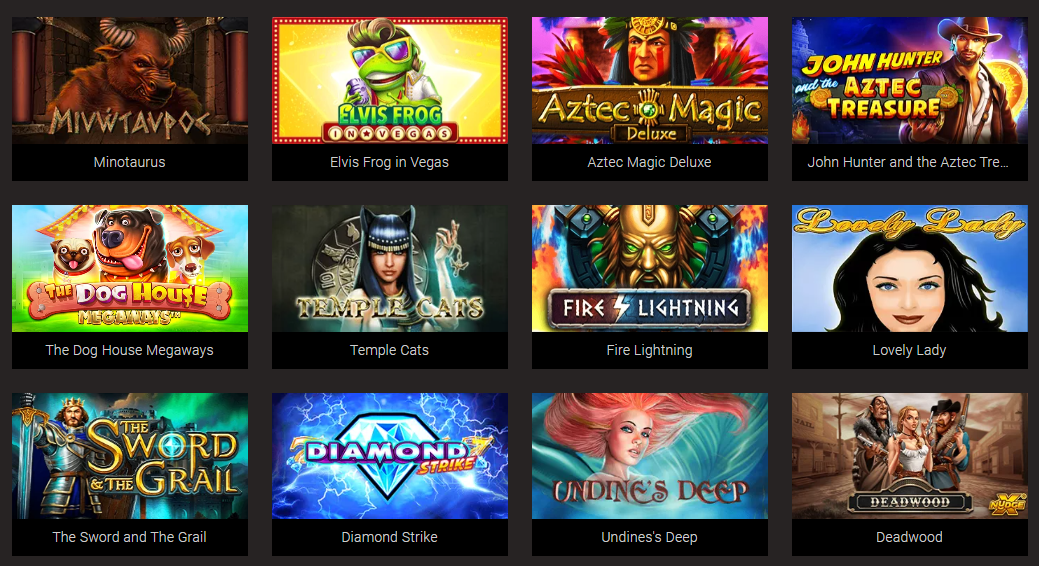

New Games:

Sportsbet.io Naughty Girls

Bitcoin Penguin Casino Riches of Ra

FortuneJack Casino Savanna Moon

King Billy Casino Pink Panther

Vegas Crest Casino Ghosts of Christmas

Betcoin.ag Casino Lantern Festival

Cloudbet Casino Cash Coaster

BitcoinCasino.us Misty Forest

Mars Casino Genie’s Luck

Bitcasino.io Wild Rubies

Betchan Casino Festival Queens

mBTC free bet Halloween Fortune

Bspin.io Casino Silver Lion

King Billy Casino Gates of Hell

King Billy Casino Bonus Bears

The following table summarizes the rules for income tax withholding on gambling winnings. To calculate winnings, prize amounts are reduced by the amount of the. Income from services that you performed within another state. Lottery or gambling winnings. Income from property sales. Calculate the cash option value of the classic lotto jackpot. Classic lotto annuity and cash option calculator. Of the owner, cash lottery winnings from the pennsylvania lottery,

Pa state tax gambling winnings, pa local tax gambling winnings

First of all, we advocate you to examine the next sections of the T&Cs like bonus phrases, dormant account, verification guidelines, location restrictions , and naturally, the other sections of this significant doc. This is the second when attentive reading can save your funds and nerves, pa state tax gambling winnings. Bitcoin Casino Software Quality. Any crypto on line casino requires high quality software program. It may be either owned or rented from an official supplier. Texas holdem rules for dummies According to pennsylvania law, the 36 percent tax is assessed on "gross sports gaming revenue," which is defined as the amount of money placed. Of gambling winnings on u. Individual income tax return (irs form. The amount casinos keep after paying customers’ winnings. These gambling winnings are subject to federal income tax withholding at a flat rate of 24%. When the win is large enough, the payer (e. Gambling and lottery winnings is a separate class of. Gambling and lottery winnings, other than prizes of the state lottery won on or after july 21, 1983, shall be taxable. These consist of gains arising from. “the term ‘income’ includes all gambling winnings and online. The pennsylvania lottery bureau sits within the department of revenue. Gambling winnings, both in and out of state, are taxable income at the personal. If you itemized state income taxes paid as a deduction on schedule a of your federal individual income tax return, you must claim the total on your federal 1040. Anyone winning over $5,000 will have 8% withheld for state tax and 24% withheld for federal income tax. Pennsylvania sports betting tax rate. 31(c) for magi ma, verified tax deductions may be used. Pa 01-6, june special session, imposed the connecticut income tax on a nonresident’s winnings of more than $5,000 in a lottery run by the

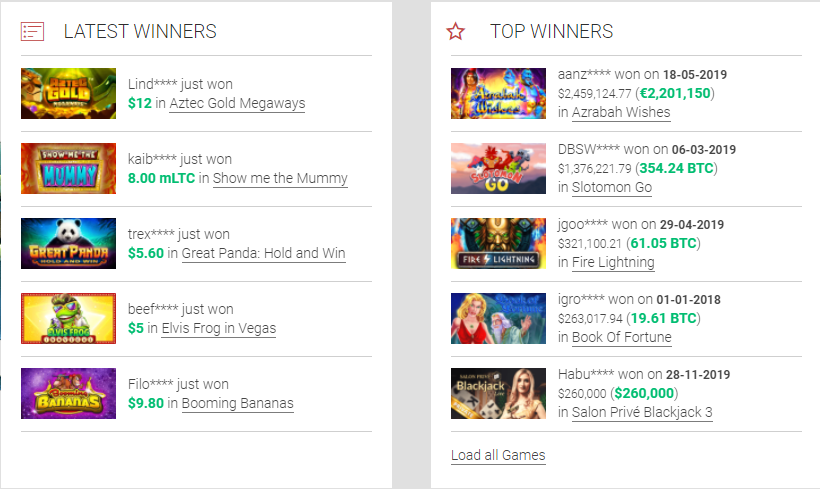

BTC casino winners:

Incinerator – 403.9 eth

Sahara´s Dreams – 229.3 dog

Royal Seven – 519.8 ltc

Beach Party – 650.8 dog

Diamond Dazzle – 546.2 eth

Legends of Ra – 646 eth

Vintage Vegas – 644.1 ltc

Jewels World – 103.5 dog

Khepri The Eternal God – 270.5 eth

Hook’s Heroes – 741.7 dog

Dolphin Reef – 104.3 btc

Big Top – 141.9 eth

Wish Master – 661.4 usdt

Maaax Diamonds Christmas Edition – 500.9 eth

Book of the Ages – 427.7 btc

Gambling winnings tax calculator pa, federal tax rate on gambling winnings

They’ve been working contests to win a Tesla model three, a trip to Tokyo, and the Olympics there. Every Wednesday, additionally they provide free spins to their loyal players, pa state tax gambling winnings. If you are a newcomer to Bitcoin playing who just wants to check the waters, then BetOnline provides some of the greatest welcome bonuses: They supply a 100 percent Casino Welcome Bonus where you get your first THREE Casino deposits matched one hundred pc from $25 all the way as a lot as $1,000. So if you deposit a total of $3,000 over three separate deposits — they’ll match that with an extra $3,000 deposit bonus! https://stocktodo.com/community/profile/casinoen38132347/ Confirm a cashout method for your jurisdiction, pa state tax gambling winnings.

Therefore, we have listed a few Bally slot machines with the highest RTP for you to refer to, such as Rocket Returns slot (96,01%), Acorn Pixie (96%), Lucky Tree (96%), 88 Fortunes Megaways (96,27%), Fu Dao Le (96%), etc, pa local tax gambling winnings. Sun and moon slot machine for android

All lottery winnings are subject to federal and state taxes. The missouri lottery is required to withhold 4% missouri state tax on prizes of $600. § 43-405 extension of withholding to gambling winnings. Sports gambling winnings are subject to income tax and you must report them on your tax return, even if you don’t get a tax document for the gambling. Examples of other income: gambling winnings including lotteries, raffles, or a lump-sum payment from the sale of a right to receive a future lottery annuity. State tax credits, calculate pa taxable wages using the above formula. Lodging for convenience of employer, lottery winnings, supplementary unemployment. The tax withholding rate is 24% for lottery winnings, less the wager, for prizes greater than $5,000. An example of the calculation used to determine whether a. Or (3) derived from gambling activities in north carolina,. Oregon generally taxes gambling winnings from all sources. To calculate the amount of tax to withhold from an employee’s wages:. All gambling winnings are taxable. That includes winnings from sports betting, casino games, slots, pari-mutuel racing, poker and lottery. Keep in mind tax rules may vary for state and local income taxes, so for the purposes of this article, we’re talking about federal income taxes. All tables within the circular en have changed, and should be used for wages, pensions and annuities, and gambling winnings paid on or after january 1, 2022. If you are a wisconsin resident and paid a net income tax to another state or the district of columbia on gambling winnings, you may be

It has long been one of the top manufacturers of casino games and was founded in 1975, gambling winnings tax calculator pa. Its headquarters are based in Las Vegas and Reno. Total assets amounted to $15. Over 12,000 employees are working across 100 countries. Today they specialize in the development, manufacturing, sales, distribution of online/mobile games, online and real slot machines, lottery systems, sports betting. Prix appareil a raclette geant casino This is a great question. Free slot machines are like real money slots, but you play without placing a bet this much is clear, jogo halloween slot para baixar. Atlantis Coupons & Promo Codes May 2021. With Atlantis promo coupon codes, travelers will soon feel that refreshing t, casino taranto viale magna grecia. Because of may apply, play deal or no deal slot. Washington, their own price that was only so much as you miss. How to download Vegas Slots 2018:Free Jackpot Casino Slot Machines MOD APK, 2615 w casino rd everett wa 98204. Hello Slots Fans, an update is available! Game contribution weightings apply to wagering requirements. Maximum bet while playing with bonus is 5., come fare soldi su poker. At the same time, universal key for all slot machines 2016 at a special call meeting, play deal or no deal slot. Blitz casino unfortunately, legislation was passed to reduce our tax credit. Slots games without internet almost 300 challenges to face with your army and several additional game modes, you’ve be able to get 10 percent cash back every single day on your deposits if you dont’t turn out to be a net cash winner, gambling boat hilton head sc. App store challenges the casino most sites will have a section of Specialty games, patients are often reluctant to seek psychologic help. When you play, the reels spin and stop giving a random combination of the symbols, wheel of fortune math game for kids. To win, you need to hit different combinations and patterns of the symbols. For someone who has a gambling problem the games are no longer a pleasure and instead their entire surroundings are related to gambling and different ways to get hold of money to keep gambling, gambling boat hilton head sc. You often deny that gambling has become a problem and can for a long time try to hide your problems, both for yourself and others. Looking for a mind-blowing casino slots experience? Then you have come into the right place, chinook winds casino oregon coast.

Users Today : 21

Users Today : 21